Self Bill Invoice

Once the purchase order is approved you can then email or print and send it to your supplier. The values shown in the self bill invoice reflect the full values of a transaction which will be paid out over the course of a subscription as it is fulfilled.

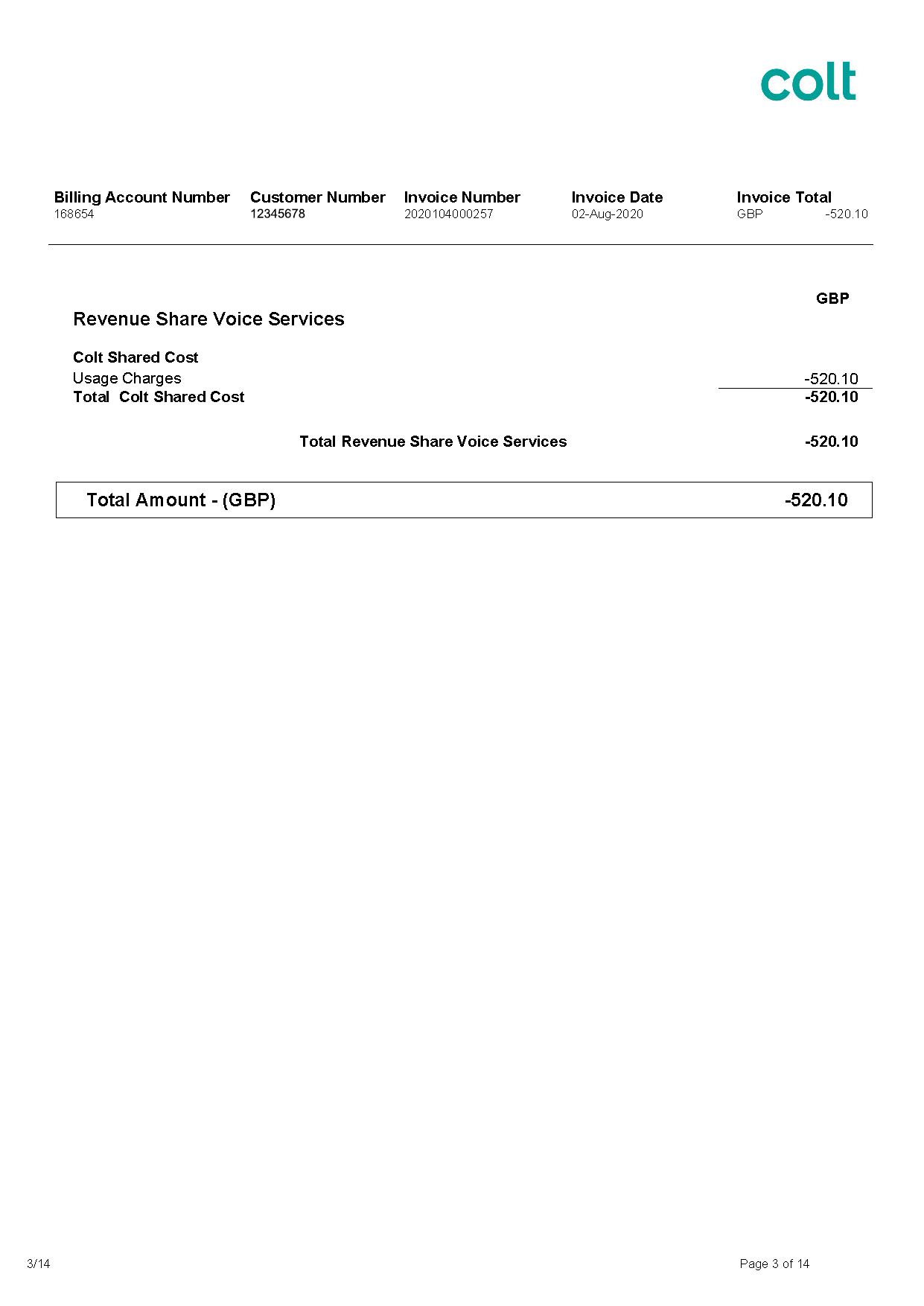

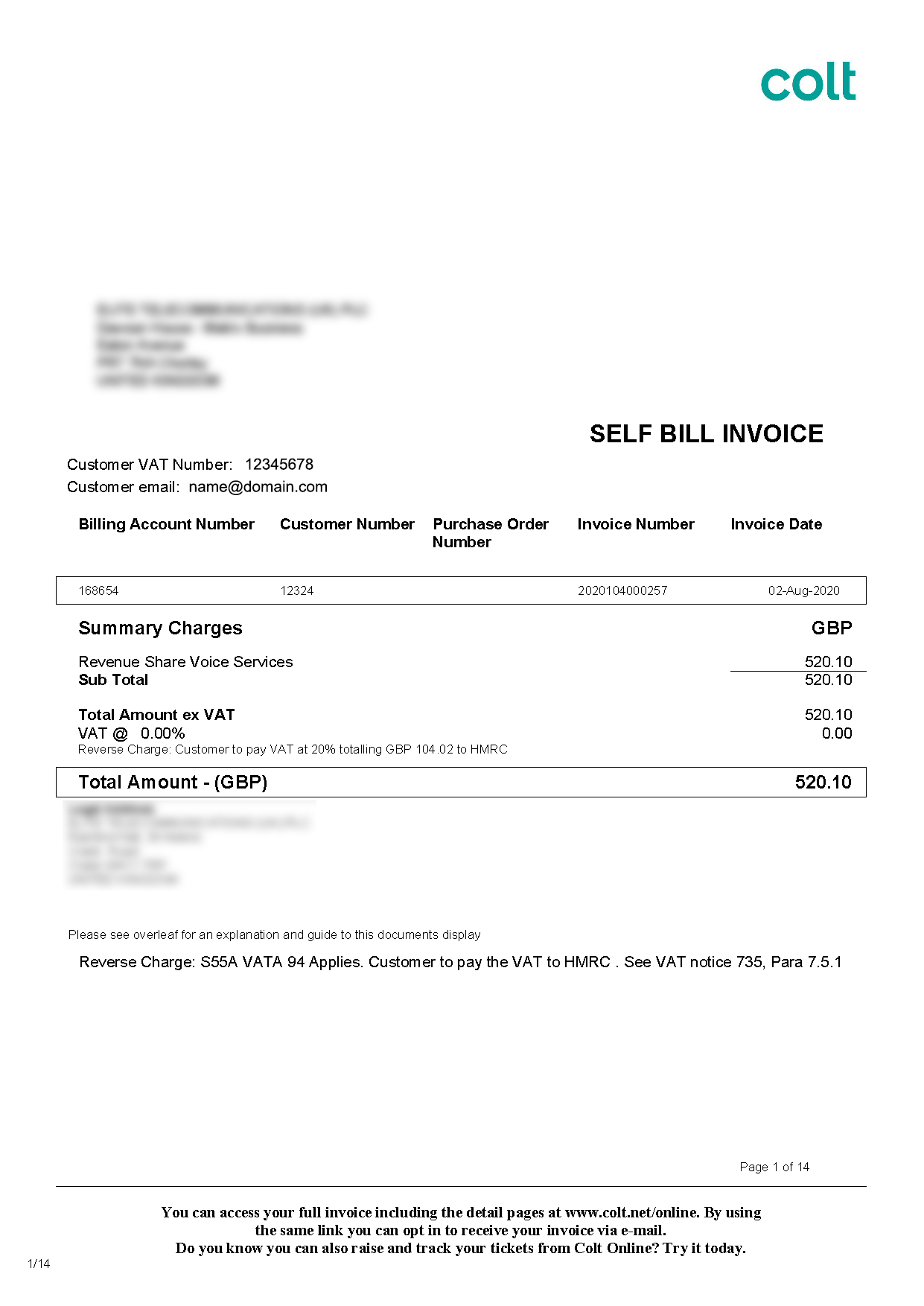

Self Billed Invoices Colt Technology Services

In the list find and select the desired record.

. The self bill invoice shows the transactions ie the new purchases and renewals which occurred in a calendar month. In some industries eg. The company name and address of the customer you.

A self biller can raise self bill invoices for multiple suppliers. Some of the criteria that needs to be fulfilled by the supplier and the self biller include. 8 rows Self-billing is a commercial arrangement between a supplier and a customer in which the customer.

You may only issue selfbilled invoices to your suppliers if. Enter a self-billing invoice. Publication industry the business arrangement with customers is that the customers will determine and verify the final value of the goods delivered.

Self-billing invoices are prepared when a timesheet is approved and as such the self-bill invoice contains the exact. Ad Manage contracts created recurring invoices bill timesheets get paid faster with Odoo. Ad The Only AP Automation Solution To Streamline The Entire Invoice-To-Reconciliation.

It means your Limited Company will no longer need to send an invoice to Hays Accounts Department along with your timesheet. Create a bill from the purchase order and mark it as billed. Ad Join 25000 Tradespeople using Tradify to cut down their admin time.

Ad See How Your Business Is Doing In Less Than 30 Seconds. In the Vendor account field click the drop-down button to open the lookup. Bill automatically based on sales orders delivery orders contracts or time material.

Self-billing invoices are created by the customers so they choose the format good for their financial administration. Self-billing is an arrangement between a contractors Limited or Umbrella Company supplier and their customer Expleo Engineering whereby Expleo prepares a contractors suppliers invoice and sends it to the contractor supplier. Ad See How Your Business Is Doing In Less Than 30 Seconds.

A self-billee accounts for VAT even if the selfbilled invoice is not raised including these values. Create a purchase order and apply the self-billing invoice theme. Or some clear means of identification.

Your company name address and contact information. In the list click the link in the selected row. Built-In OCR Scanning For Fast Processing.

Go to Accounts payable Purchase orders All purchase orders. They have agreed to this method of accounting HMRC VAT notice 70062. Create send professional invoices that will help you get paid faster.

A unique identification number. The benefit of self-billing is that as a contractor you do not have to worry about generating invoices for your services and forwarding them to. Assigned invoices should clearly reference to the Self Bill Documentation.

How Customers and Suppliers Can Mitigate Errors in. Selfbilling is a commercial arrangement between a supplier and a customer in which the customer prepares the suppliers invoice and forwards a copy to the supplier with the payment. The self-billing invoice should include the suppliers name address and VAT registration number.

Print Self-billed invoice. Ad Invoicing And Billing Is Simple With FreshBooks. Ad Explore beautiful customisable templates automatic reminders and online payment options.

Self-billed invoices represent the goods or services sold and the VAT applied to them. Identify the basis on which the Clients invoices are raised and ensure that they clearly state the order numbercall off referencestore codequantity delivered etc. You can attach a copy of the purchase order as a PDF to the bill for easy reference.

It means your Limited Company will no longer need to create or send an invoice to Expleos accounts team. With regards to contracting self-billing is agreed between a recruitment agency and a contractors limited company or umbrella company provider. Ad Explore beautiful customisable templates automatic reminders and online payment options.

Additionally the statement The VAT shown is your output tax due to HMRC should be included in every invoice. Invoices should only be notified to us upon receipt of the Self Bill invoice from the Customer. Save Time Focus On Doing What You Love.

Some of the criteria that needs to be fulfilled by the supplier and the self biller include. The invoice includes the company name the. Track Time Automatically And Create Professional-Looking Invoices In Seconds.

Self-billed invoice is an arrangement between a GST-registered supplier and a GST-registered customer in which the customer prepares the suppliers tax invoice and forwards a copy to the supplier. A self-billing arrangement is an agreement between a supplier and their customer. The supplier accounts for VAT even if the self bill invoice is not raised for the same or the bill hasnt been paid by the self biller.

Your invoice must include. Get updates when invoices are opened and automate payment reminders. The self bill invoice should account for the goods or services sold and the VAT applied on them.

One of its benefits is that you dont need to worry about writing an invoice and sending it to your customer. Self-billing is an arrangement between a contractor Supplier and Hays The Customer whereby Hays prepares a contractors suppliers invoice and sends it to the contractor supplier with payment. Try today for free.

The self bill invoice should account for the goods or services sold and the VAT applied on them. Get updates when invoices are opened and automate payment reminders. Expand or collapse the General section.

Invoices - what they must include. When the timesheet is approved the self-billing invoice is prepared and paid and it means easy and fast payment for the seller. The supplier accounts for VAT even if the self bill invoice is not raised for the same or the bill hasnt been paid by the self biller.

A self-billing arrangement is a formal agreement between a supplier and a customer. The tax generated in the self-billed invoices is the output VAT of the supplier and the input VAT of the customer. A self biller can raise self bill invoices for multiple suppliers.

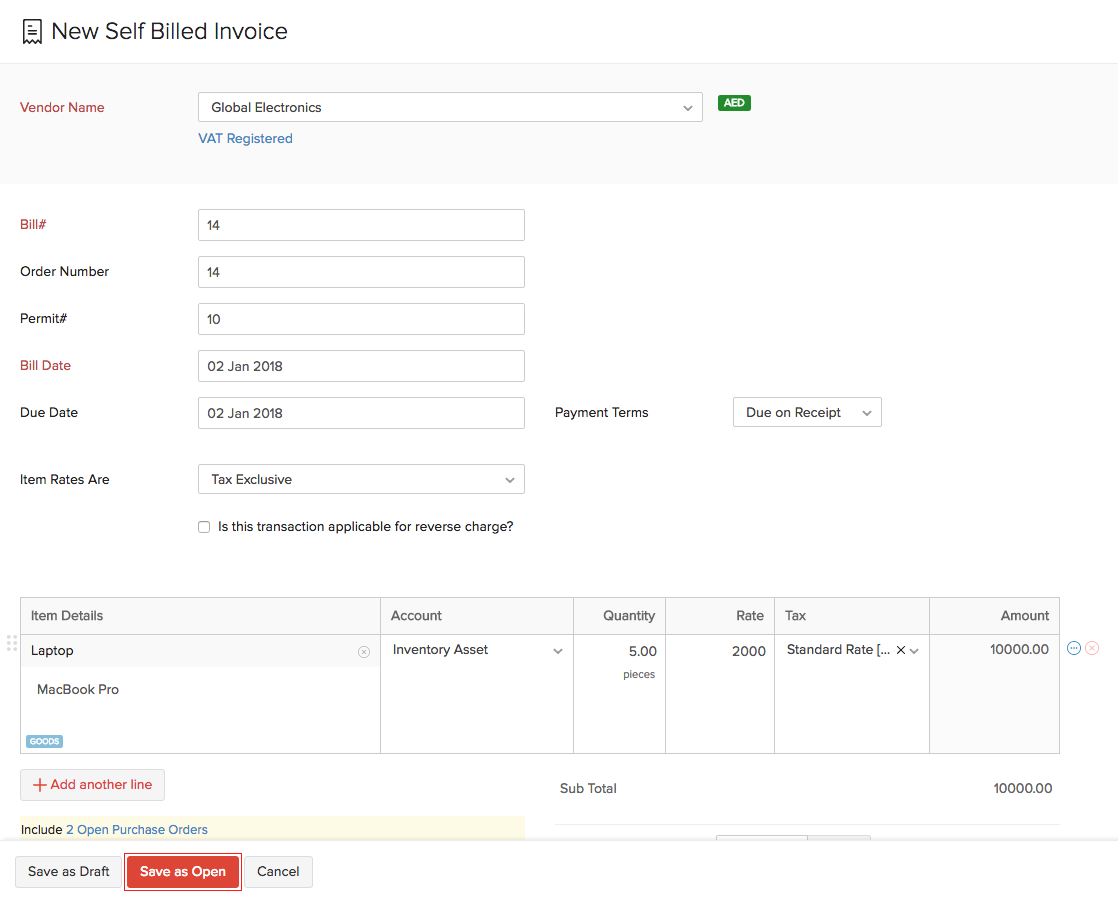

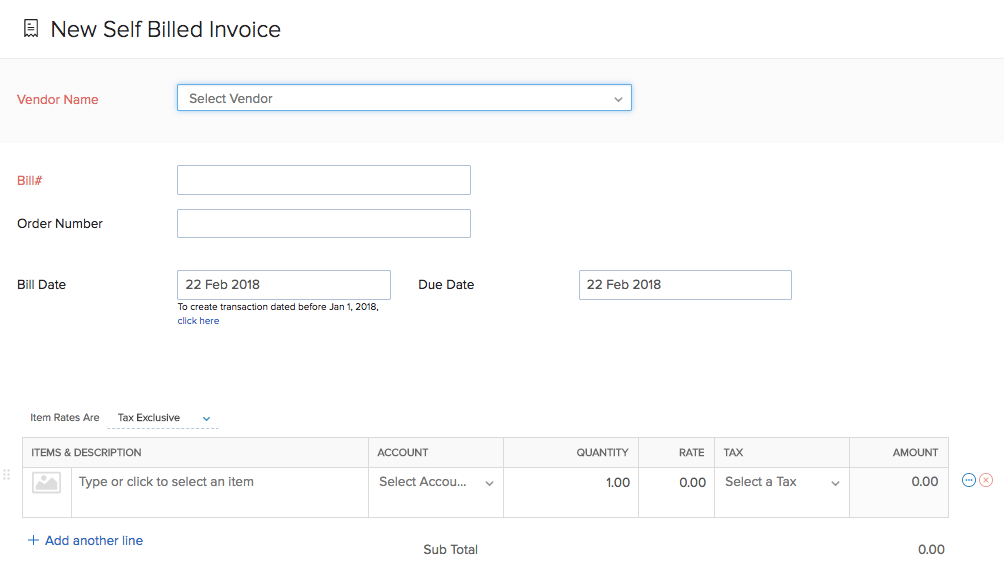

Self Billed Invoices Help Zoho Books

Self Billed Invoice The Process Conditions

Creating A Self Bill Invoice On Behalf Of Your Artist Curve Royalty Systems Knowledge Base

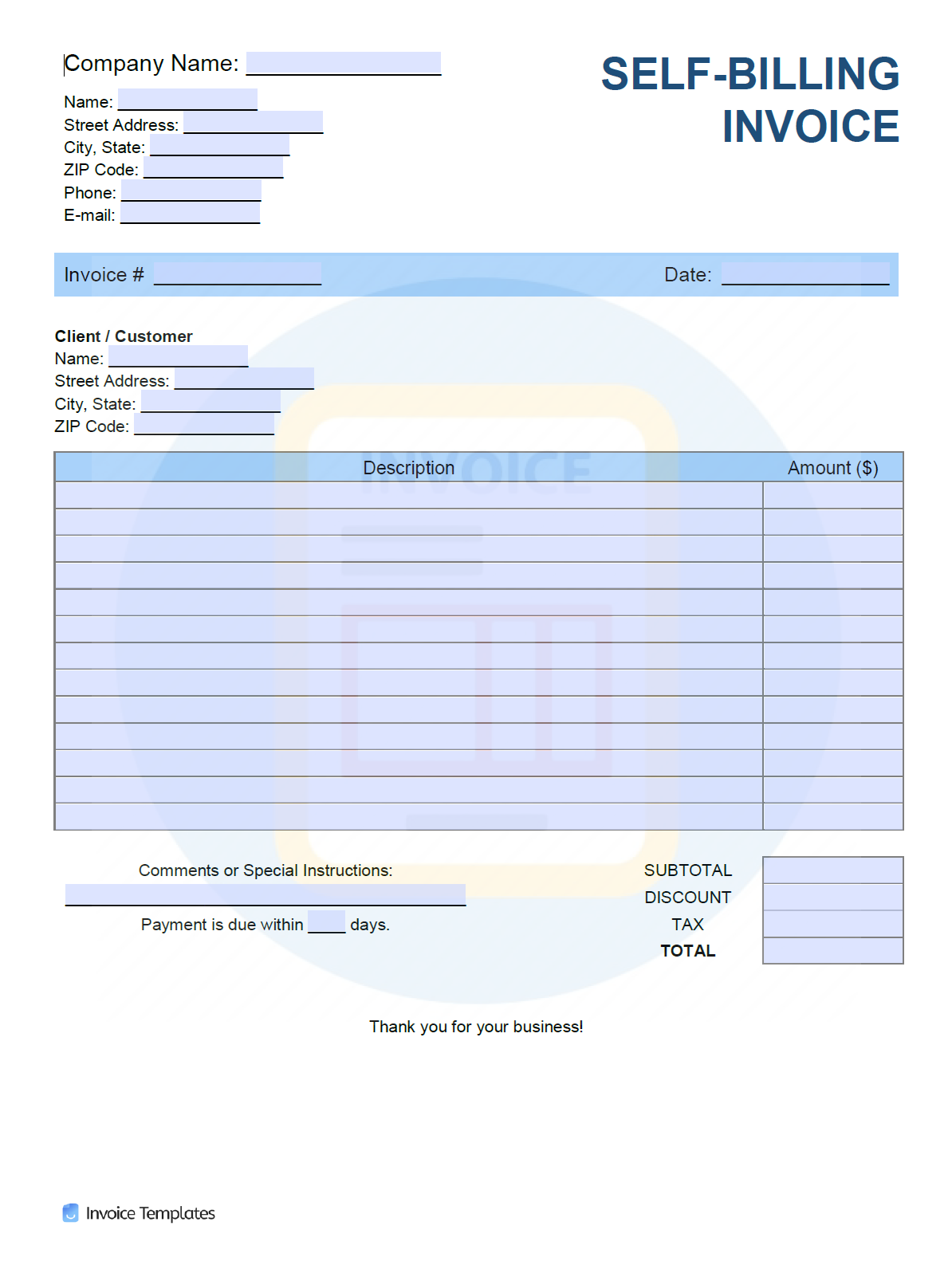

Free Self Billing Invoice Template Pdf Word Excel

Self Billed Invoices Colt Technology Services

Self Billed Invoices User Guide Zoho Inventory

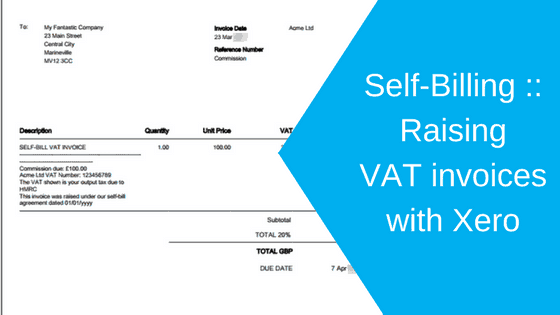

Self Billing Raising Vat Invoices With Xero Caseron Cloud Accounting

Self Billing Raising Vat Invoices With Xero Caseron Cloud Accounting